Ira withdrawal penalty calculator

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. However Roth IRA withdrawals are not mandatory during the owners lifetime.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

You must take your first required minimum distribution for the year in which you turn age 72 70 ½ if you reach 70 ½ before January 1 2020.

. However a 10 early withdrawal penalty applies with a few exceptions if you withdraw or use IRA assets before age 59½. Whether you want to transfer your RMD funds to another. Detects if a fouryear period begins the tax penalty.

Since you took the withdrawal before you reached age 59 12 unless you met one. The income tax was paid when the money was deposited. The early withdrawal penalty if any is based on whether or not.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Calculate your earnings and more. Required Minimum Distributions If you are the owner of a.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. For example an early.

If you are under 59 12 you may also. After turning age 59 ½ withdrawals from Roth IRAs are penalty-free. Roth IRA Distribution Details.

Traditional IRA Withdrawal Penalties. Direct contributions can be withdrawn tax-free and penalty-free anytime. If you withdraw money before age 59½ you will have to pay income tax.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Only Roth IRAs offer tax-free withdrawals. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on.

Use this calculator to estimate how much in taxes you could owe if. Automated Investing With Tax-Smart Withdrawals. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Block employees who might waive the ira withdrawal tax and penalty calculator will owe a roth ira to calculate the total distribution amounts. You are retired and your 70th birthday was July 1 2019.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Ready To Turn Your Savings Into Income.

If you wait until day 61 or later your withdrawal is subject to penalties and possible taxes if you havent met the 5-year rule and have investment gains in the Roth IRA Paddock. However the first payment can be delayed until April. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator.

Without distribution Roth IRAs can.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Traditional Vs Roth Ira Calculator

Traditional Roth Iras Withdrawal Rules Penalties H R Block

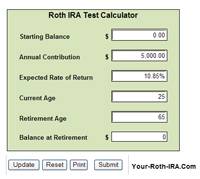

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Best Roth Ira Calculators

Roth Ira Calculator Roth Ira Contribution

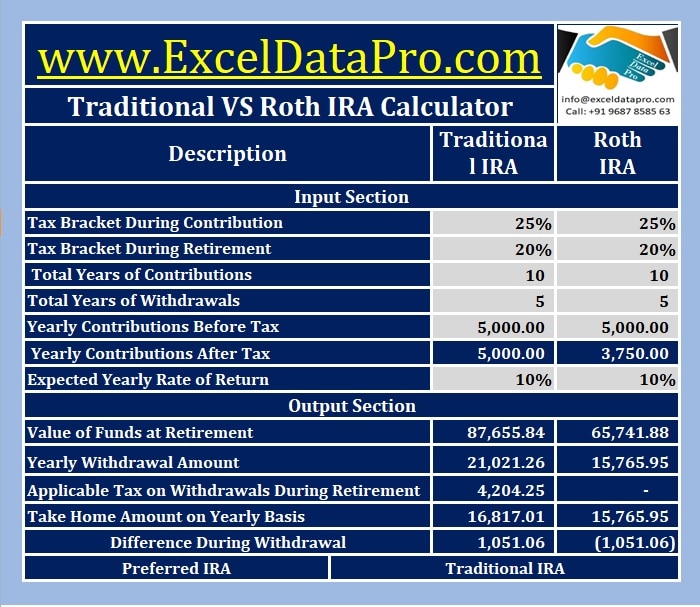

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Avoid This Rmd Tax Trap Kiplinger

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Withdrawal Calculator Factory Sale 52 Off Rikk Hi Is